Today’s lesson is a virtual treasure trove of wisdom and insight from some of the best trading minds of all time. We are going to go on a journey of discovery and learn a little about some of the best traders ever and dissect some of their famous quotes to see what we can learn and how it applies to our own trading.

Today’s lesson is a virtual treasure trove of wisdom and insight from some of the best trading minds of all time. We are going to go on a journey of discovery and learn a little about some of the best traders ever and dissect some of their famous quotes to see what we can learn and how it applies to our own trading.

The way to learn anything is to learn from the greats, have mentors, teachers, study and read; you must make a concerted effort to absorb as much knowledge from the best in your field as possible, for that is truly the fastest way to success, be it in trading or any other field.

Below, you will find a brief introduction to 10 of the best traders of all time, followed by an inspiring quote from them and how I view that quote and apply it to my own trading principles. Hopefully, after reading today’s lesson you will be able to apply this wisdom to your own trading and start improving your market performance as a result…

George Soros

George Soros gained international notoriety when, in September of 1992, he invested $10 billion on a single currency trade when he shorted the British pound. He turned out to be right, and in a single day the trade generated a profit of $1 billion – ultimately, it was reported that his profit on the transaction almost reached $2 billion. As a result, he is famously known as the “the man who broke the Bank of England.”

Soros went off on his own in 1973, founding the hedge fund company of Soros Fund Management, which eventually evolved into the well-known and respected Quantum Fund. For almost two decades, he ran this aggressive and successful hedge fund, reportedly racking up returns in excess of 30% per year and, on two occasions, posting annual returns of more than 100%.

Here is a famous quote from Mr. Soros:

Jesse Livermore

Livermore, who is the author of “How to Trade in Stocks”(1940), was one of the greatest traders of all time. At his peak in 1929, Jesse Livermore was worth $100 million, which in today’s dollars roughly equates to $1.5-13 billion, depending on the index used. He is most famous, perhaps, for selling short U.S. stocks before they crashed in 1929, swelling his bank account to $100 million.

Here is a famous quote from Jesse Livermore:

The above quote by Jesse Livermore is one of my favorites. I am all about keeping a low-frequency trading approach and trading like a sniper not a machine gunner which is also what Livermore is saying here. Playing the market when all factors are you in favor means, as with other quotes in this lesson (seeing a theme here?) trading with confluence. He says you should be out of the market at times for emotional as well as economic reasons. Meaning, for your trading account’s sake and your mindset’s sake, you should not be in the market all the time. In fact, most of the time you should be out of the market, which is a cornerstone of my trading philosophy.

Ed Seykota

Trading as a trend follower, Ed Seykota turned $5,000 into $15,000,000 over a 12-year time period in his model account – an actual client account. In the early 1970s, Seykota was hired as an analyst by a major brokerage firm. He conceived and developed the first commercial computerized trading system for managing clients’ money in the futures markets

Here is quote from Ed Seykota from The Market Wizards by Jack D. Schwager:

John Paulson

Paulson became world-famous in 2007 by shorting the US housing market, as he foresaw the subprime mortgage crisis and bet against mortgage backed securities by investing in credit default swaps. Sometimes referred to as the greatest trade in history, Paulson’s firm made a fortune and he earned over $4 billion personally on this trade alone.

Here is a great quote from John Paulson:

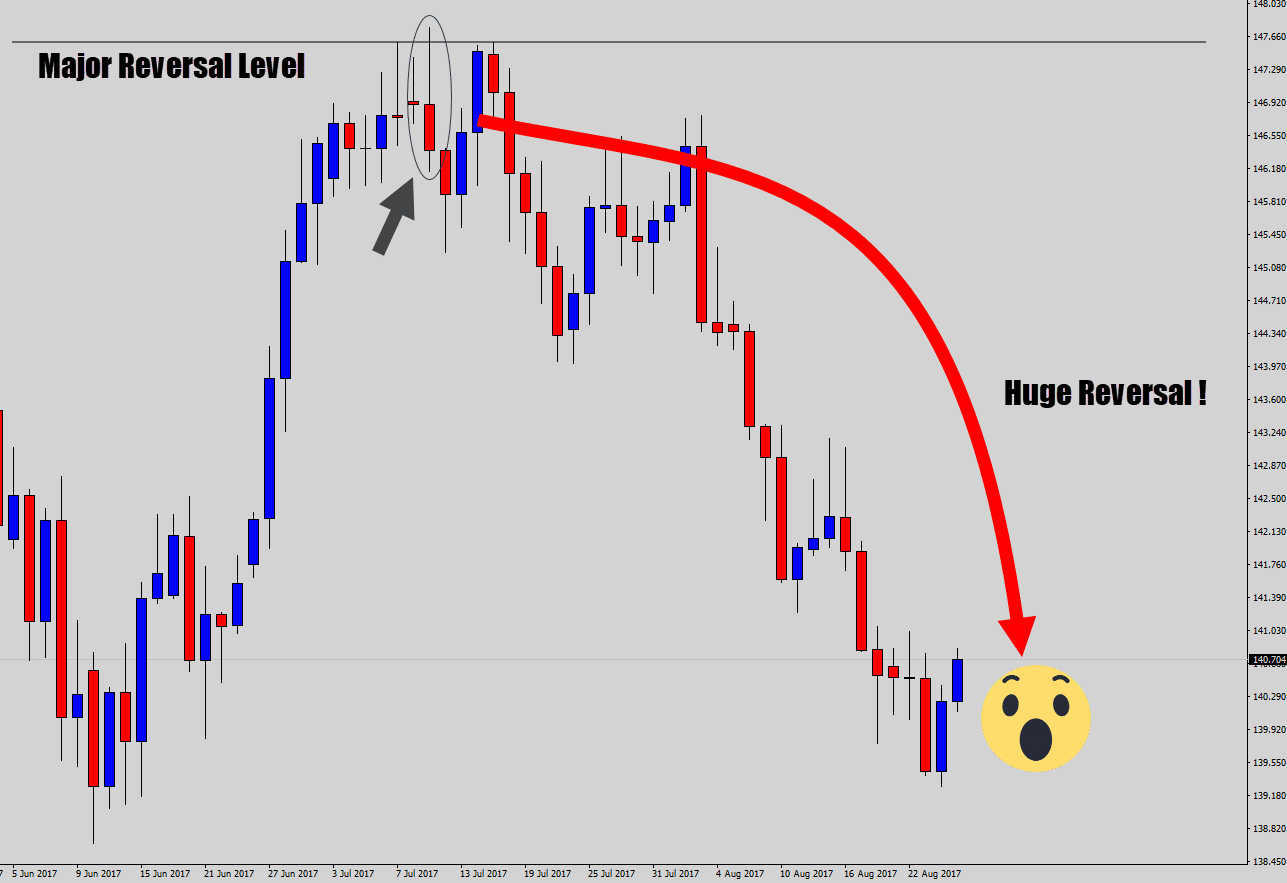

What he means here, is that most investors and traders will tend to buy when a market is high, typically because that’s when it looks and feels good to buy. However, when a market has already moved up a lot, it’s typically ready to pullback, which is why I like to trade on market pull backs in most cases. The inverse is true for shorting; when a market has sold-off big time, you usually don’t want to sell, or you’ll end up selling the bottom, so to speak. You want to wait for a bounce in price, back to a resistance or value area, then watch for a price action sell signal there to rejoin the trend after a pull back.

Paul Tudor Jones

Paul Tudor Jones shorting of Black Monday was one of the most famous trades ever. Paul Tudor Jones correctly predicted on his documentary in 1986 based on chart patterns that the market was on the path to a crash of epic proportions. He profited handsomely from the Black Monday crash in the fall of 1987, the largest single-day U.S. stock market decline (by percentage) ever. Jones reportedly tripled his money by shorting futures, making as much as $100 million on that trade as the Dow Jones Industrial Average plunged 22 percent. An amazing trade to walk away from with a fortune when so many others were ruined in the aftermath. He played it to perfection. His funds had great consistent returns for decades.

Here is a favorite quote of mine from Paul Tudor Jones featured in the Market Wizards:

What Jones is saying here, is that there will be a time when every trader makes a huge mistake regarding money management, and they must take a cold, hard look at themselves and decide what to do next. Will you continue to bleed money from your account by continuing to make poor money management decisions? Or, will you finally get disciplined and “businesslike” in your trading? In trading, money management is literally what determines your fate, so you need to focus on it early-on if you want to have any chance of success.

Richard Dennis

Richard J. Dennis, a commodities speculator once known as the “Prince of the Pit,” was born in Chicago, in January, 1949. In the early 1970s, he borrowed $1,600 and reportedly made $200 million in about ten years. Dennis and his friend William Eckhardt, are most famous for starting the Turtle Traders, which was a group of 21 average people to whom they taught their rules to and proved that anyone, given the right training, could trade successfully.

Here is a good quote from Richard Dennis:

Richard Dennis was famously a very successful trend trader and in the above quote he is stating his feelings on trading counter trend. Interestingly, this is pretty much how I feel about trading counter-trend; sometimes it’s warranted, but most of the time it’s not, and it takes a skilled trader to be able to trade counter-trend successfully. I teach my students to master trading with the trend first and foremast and to make that the most important piece of their technical analysis.

Stanley Druckenmiller

Stanley Druckenmiller is an American investor, hedge fund manager and philanthropist.

In 1988, he was hired by George Soros to replace Victor Niederhoffer at Quantum Fund. He and Soros famously “broke the Bank of England” when they shorted British pound sterling in 1992, reputedly making more than $1 billion in profits. They calculated that the Bank of England did not have enough foreign currency reserves with which to buy enough sterling to prop up the currency and that raising interest rates would be politically unsustainable.

The above quote is reference to George Soros who mentored Druckenmiller for a while. This quote fits perfectly with an article I wrote recently about how you don’t have to be right to make money trading. Most traders get far too concerned about the number of winners they have compared to losers when really, they should totally forget about that number and instead focus on their overall risk / reward. In other words, how much money are they making for every dollar they have risked.

Jim Rogers

James Beeland “Jim” Rogers, Jr. is a Singapore based business magnate of American origin. Regarded by the business world as a brilliant investor, Rogers is also an author and financial commentator. He co-founded the global investment partnership, Quantum Fund, along with George Soros, another equally brilliant businessman.

Here’s one of my all-time favorite trading and investing quotes, courtesy of Mr. Rogers:

I really like the part above where Jim Rogers says “I just wait until there is money lying in the corner…” because that really sums up what I try to teach my students as well as my own personal trading style. Rogers is dead-on with the above quotes; most traders do WAY too much…there is nothing wrong with doing nothing if there isn’t anything to do! In other words, don’t force a trade if an obvious one isn’t there, it’s better to save your capital for a solid opportunity that’s just around the corner.

Ray Dalio

Raymond Dalio is an American billionaire investor, hedge fund manager, and philanthropist. Dalio is the founder of investment firm Bridgewater Associates, one of the world’s largest hedge funds. As of January 2018, he is one of the world’s 100 wealthiest people, according to Bloomberg.

Here is a pretty deep quote by Ray Dalio:

This quote by Mr. Dalio is deep, for a few reasons. One, having a sensitive ego is very bad in trading, because the fact is, you’re going to have losing trades, probably more than you want. So, if you become overly-affected / emotional by every loser, it’s going to catapult you into a huge string of trading mistakes, as I wrote about more in-depth in my article on the top trading mistakes people make.

Next, being right or wrong is and should be 100% irrelevant in trading. As the late, great Mark Douglas teaches, you can be wrong on average and still make money, and your trading success or failure doesn’t depend on whether you’re right on your next trade, read my article on the secret to trading success for more on this. Finally, you must determine what your strengths and weaknesses are as a person before you can find trading success. We all drag our personal baggage into the markets and it influences our trading, for better or worse.

Warren Buffet

Known as the “Oracle of Omaha,” Warren Buffett is one of the most successful investors of all time. He runs Berkshire Hathaway, which owns more than 60 companies, including insurer Geico, battery maker Duracell and restaurant chain Dairy Queen. He has committed to giving more than 99% of his fortune to charity. So far, he has given nearly $32 billion.

Here is perhaps a lesser-known quote from Warren but one that I like nonetheless:

To me, this quote is saying that high-probability trade signals happen infrequently, which is something I teach as any of you know who have followed me for any length of time. Thus, when you do get a nice and obvious / confluent trade signal (there’s that confluent word again) you need to maximize your gains, not take a quick / easy profit. This fits nicely in my teachings about the power of risk reward and how to catch big moves in the market. I am all about waiting patiently, with discipline, for days, weeks or even months and then pouncing on that one super-obvious setup that will net me a large 1:3, 1:4, 1:5 or even greater winner. This is the basis behind my approach that proves you don’t need to win a lot to make money trading.

Conclusion

Personally, if you’re a beginning or struggling trader, I think the most important thing to takeaway from all the wisdom in today’s lesson is to first get YOURSELF straight; get your money straight, get your patience and discipline straight, know what your trading edge is and how to properly trade it BEFORE you start risking real money in the markets. If you do this, you will largely be trading in-line with the insight and advice that the above trading greats have provided you with.

Note:

Risk Disclaimer

All information is for educational purposes only. Nothing should be considered as a buy or sell recommendation. The risk of loss in trading stocks, commodity futures and options is substantial. Before trading, you should carefully consider your financial position to determine if trading is appropriate. When trading stock, futures or options, it is possible to lose more than the full value of your account. All funds committed should be risk capital. Past performance is not necessarily indicative of future results. This email may is a paid advertisement. It could be for a product or service that is not offered, recommended or endorsed by Stock Alphabets and neither the company nor its affiliates bear responsibility or control over the content of the advertisement and the product or service offered. Proceed at your own risk.

The information and material contained in these pages and the terms, conditions, and descriptions that appear are subject to change without prior notice. Investments in equity shares, debentures etc, are not obligations of or guaranteed by the Stock Alphabets, and are subject to investment risks.

All information is for educational purposes only. Nothing should be considered as a buy or sell recommendation. The risk of loss in trading stocks, commodity futures and options is substantial. Before trading, you should carefully consider your financial position to determine if trading is appropriate. When trading stock, futures or options, it is possible to lose more than the full value of your account. All funds committed should be risk capital. Past performance is not necessarily indicative of future results. This email may is a paid advertisement. It could be for a product or service that is not offered, recommended or endorsed by Stock Alphabets and neither the company nor its affiliates bear responsibility or control over the content of the advertisement and the product or service offered. Proceed at your own risk.

The information and material contained in these pages and the terms, conditions, and descriptions that appear are subject to change without prior notice. Investments in equity shares, debentures etc, are not obligations of or guaranteed by the Stock Alphabets, and are subject to investment risks.

What’s

What’s

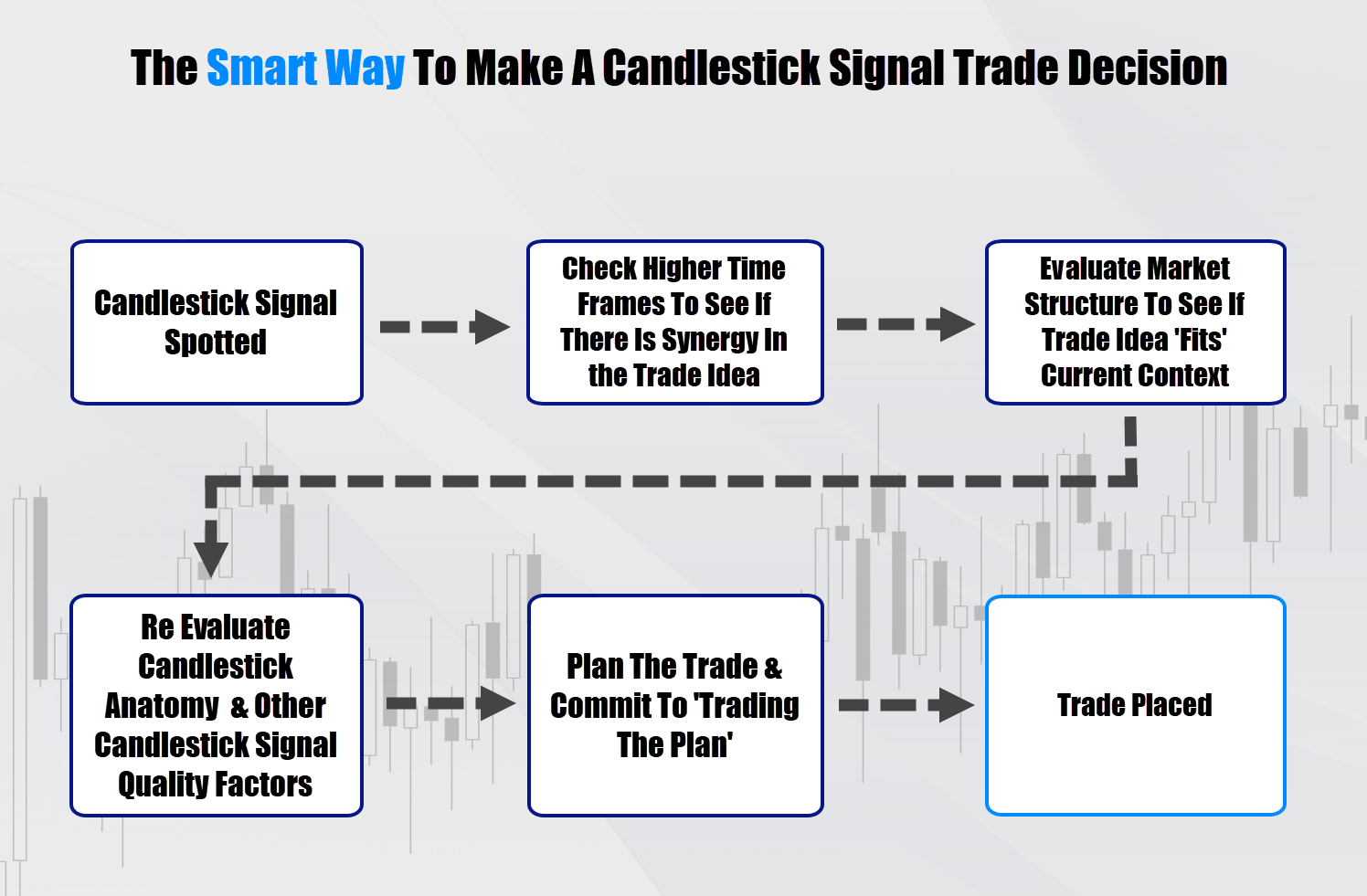

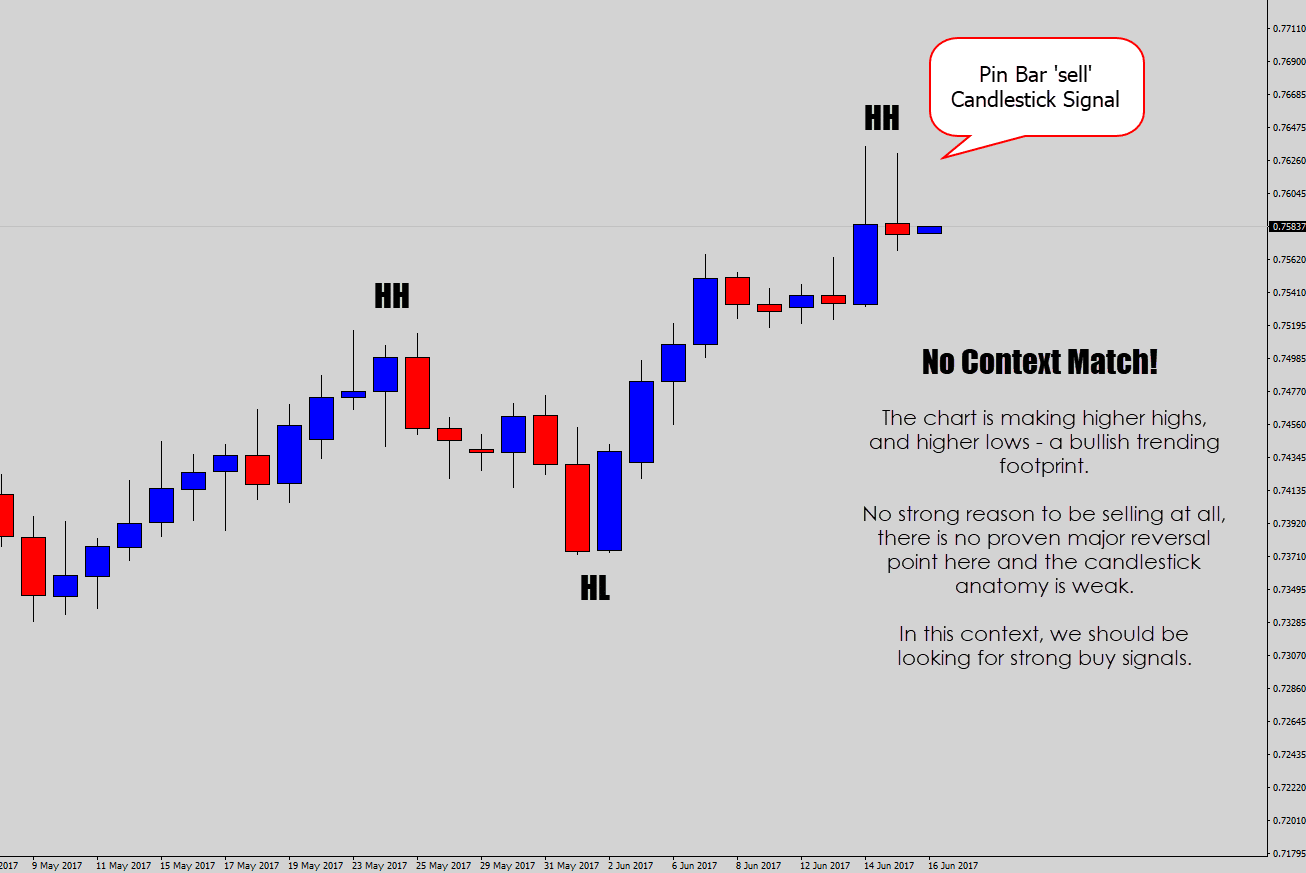

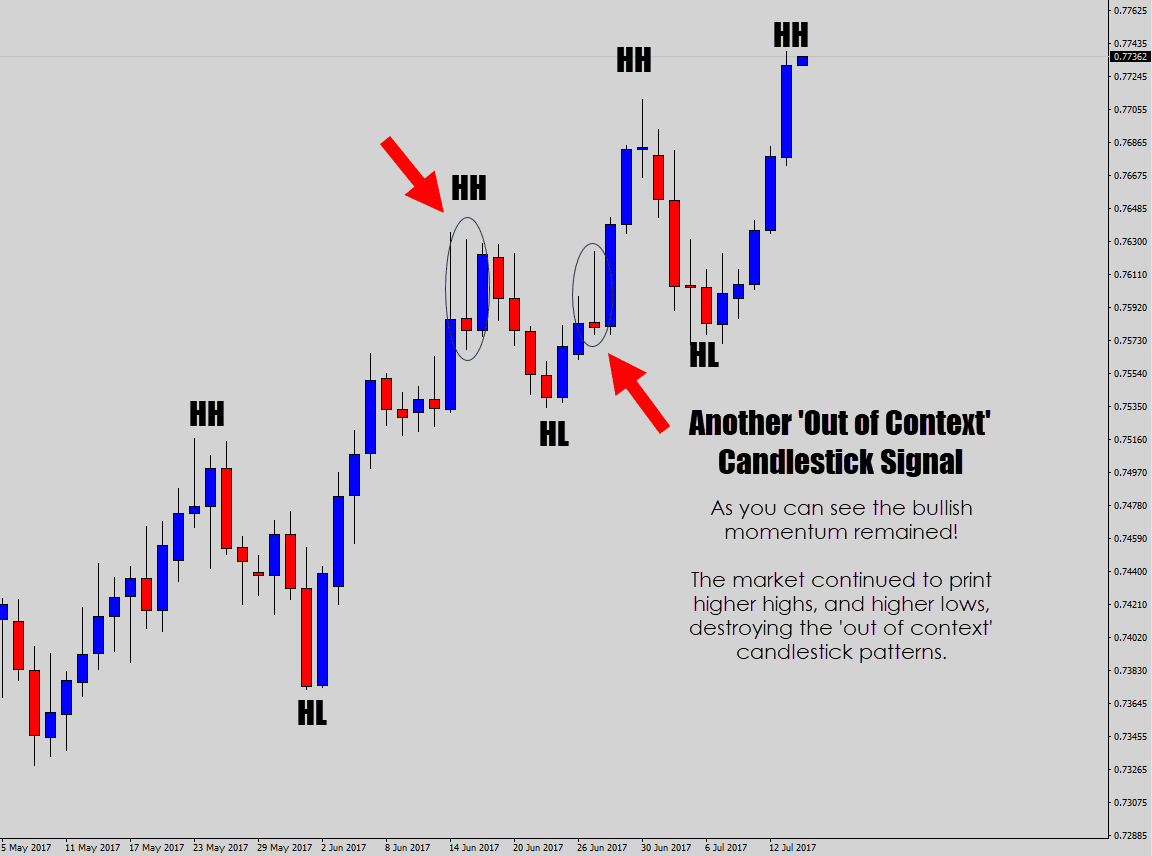

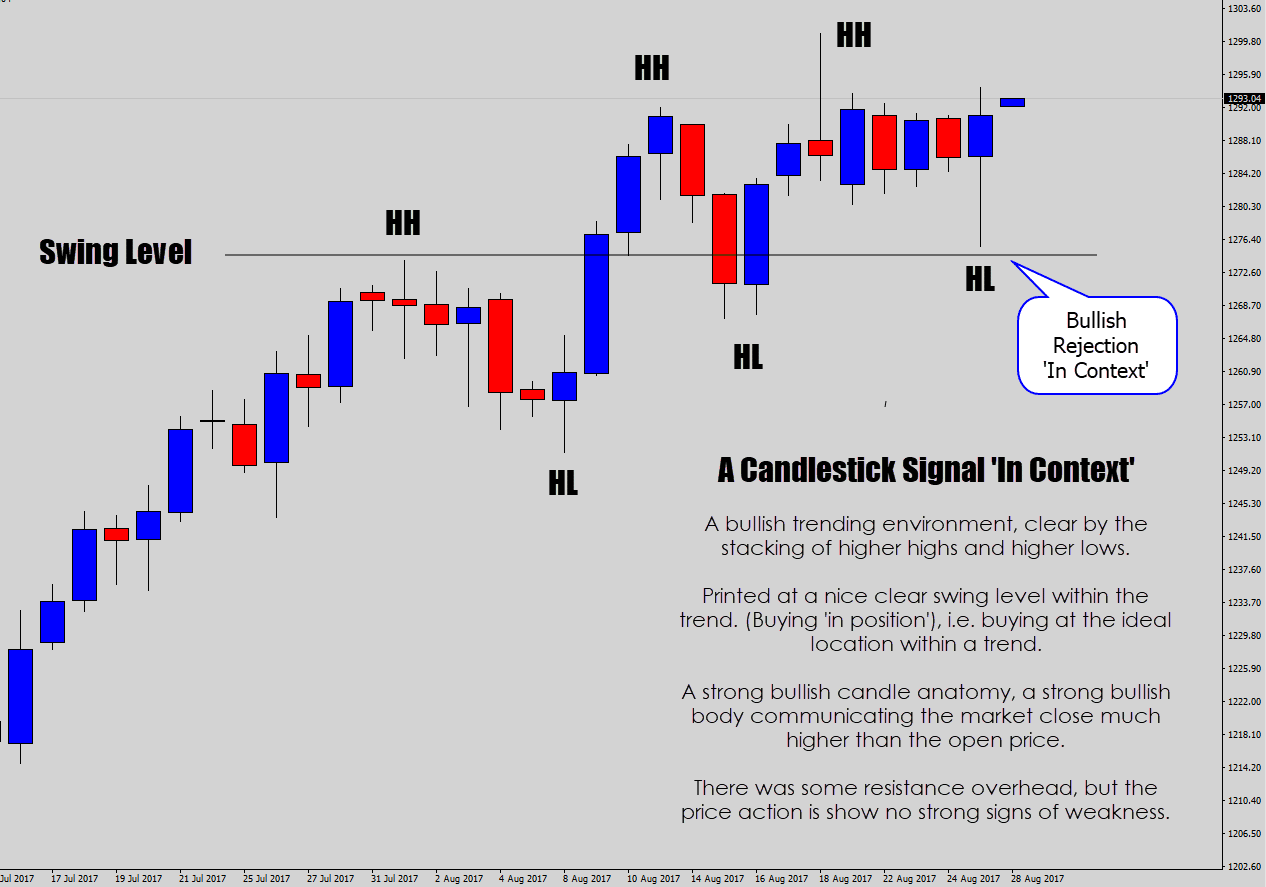

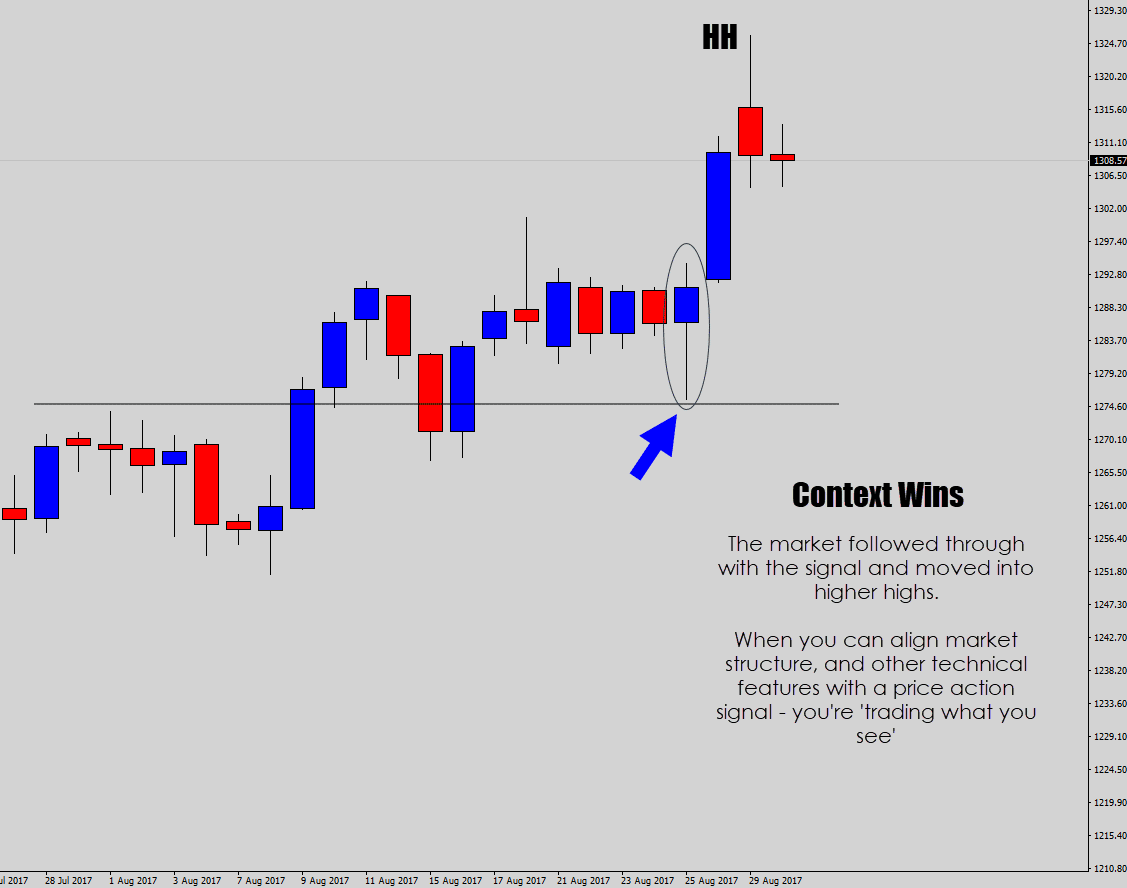

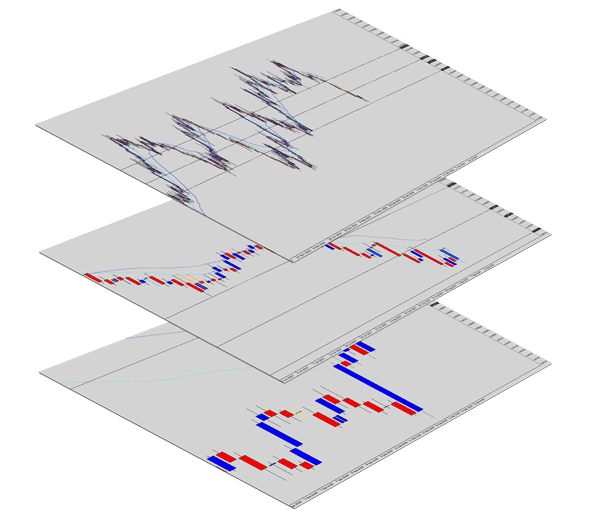

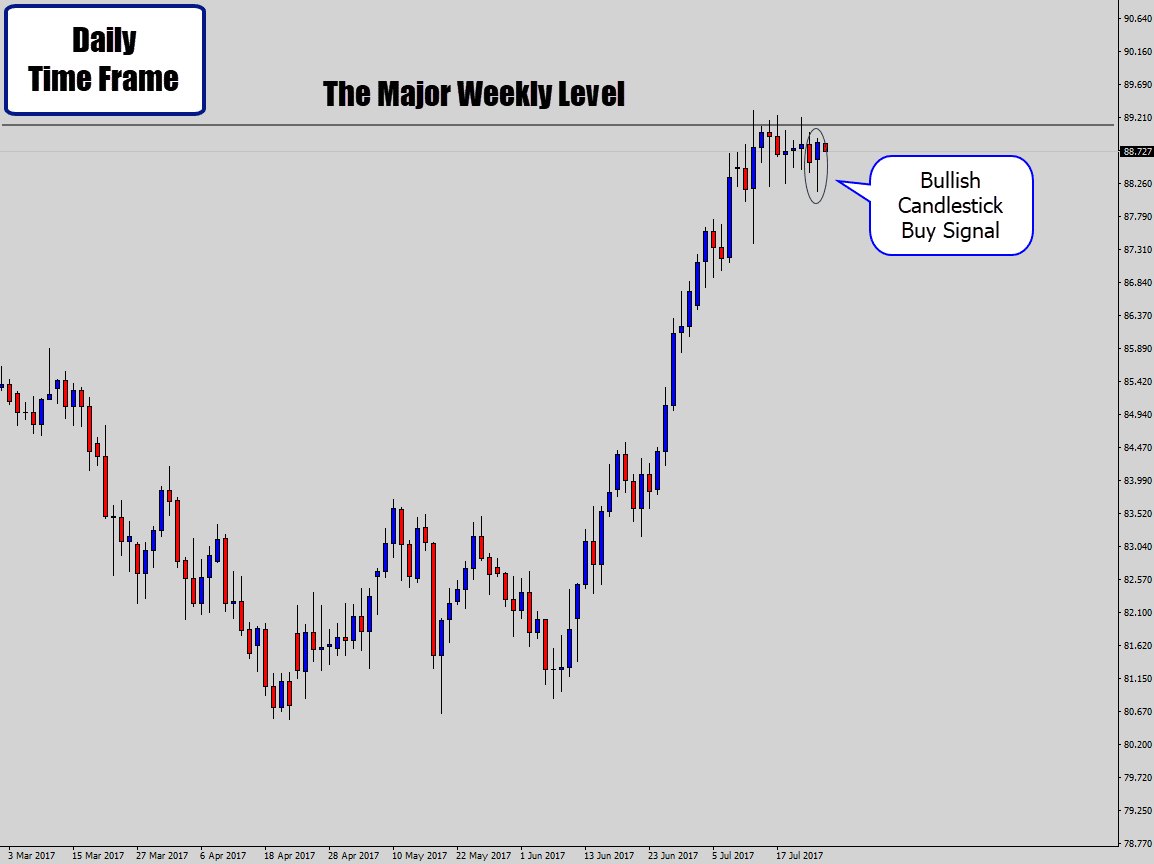

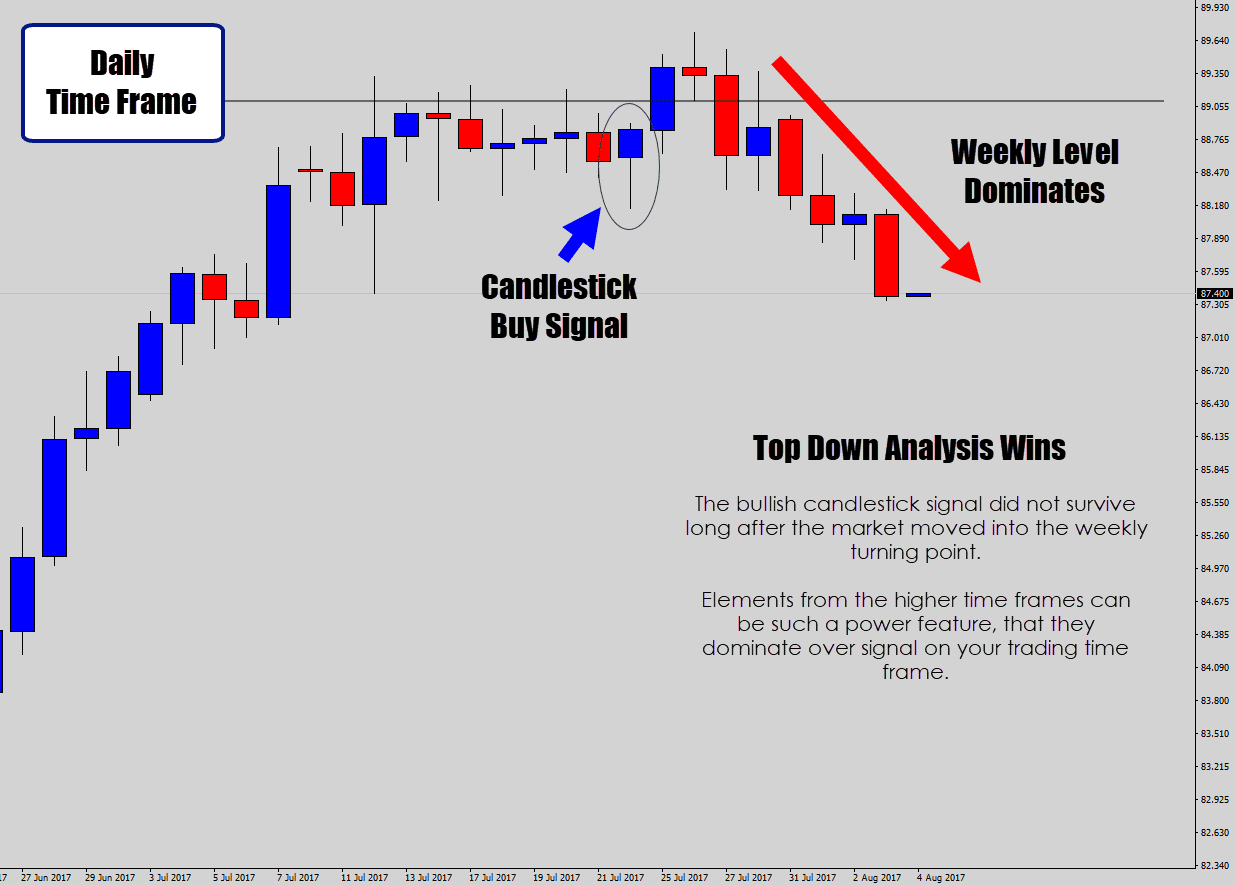

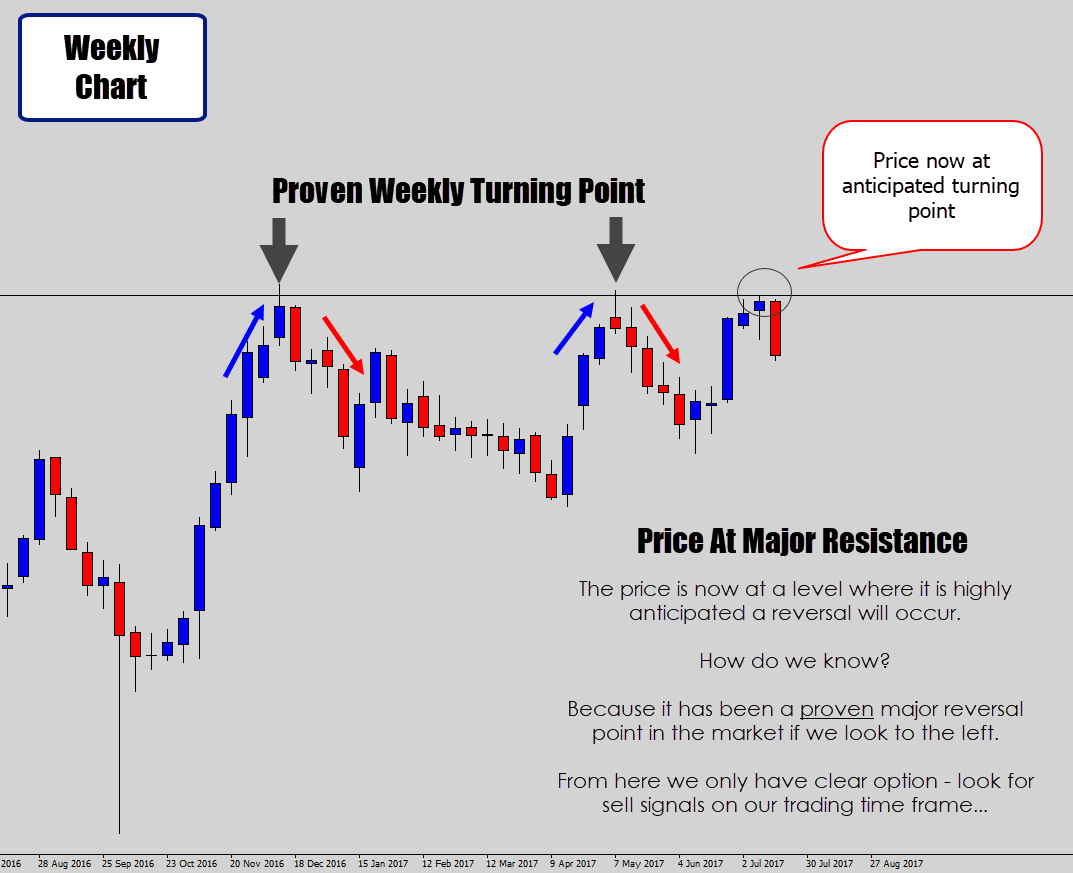

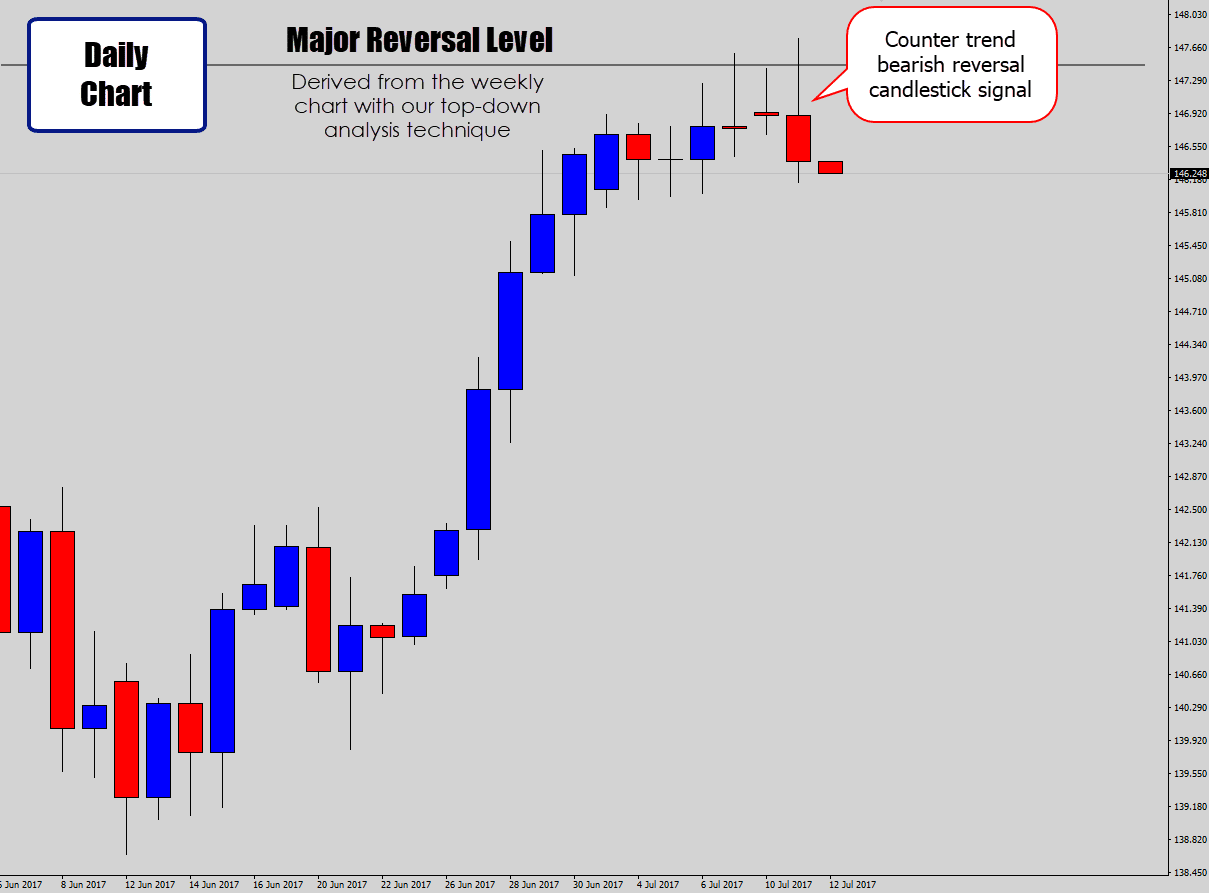

You might have heard the term ‘top down analysis’ being passed around the Forex communities from time to time. This nicely complements the ‘getting context’ tip above.

You might have heard the term ‘top down analysis’ being passed around the Forex communities from time to time. This nicely complements the ‘getting context’ tip above.

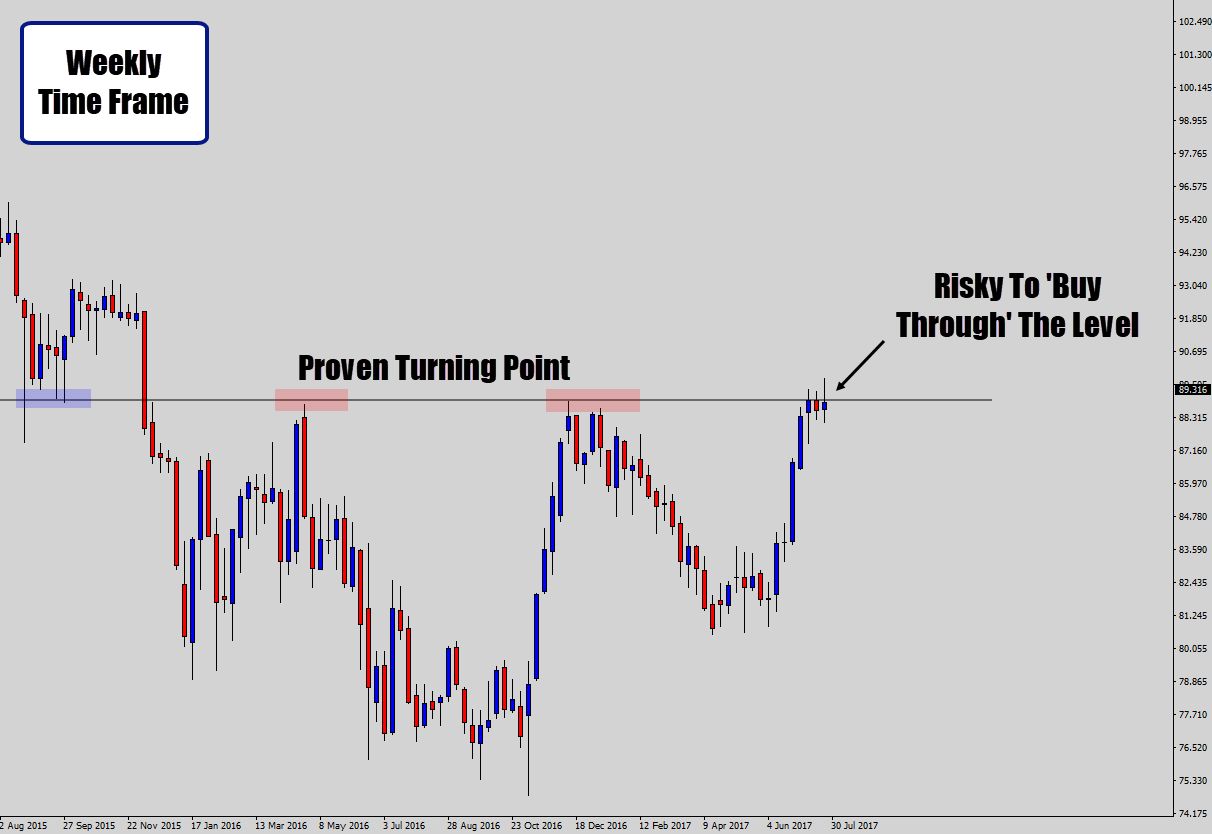

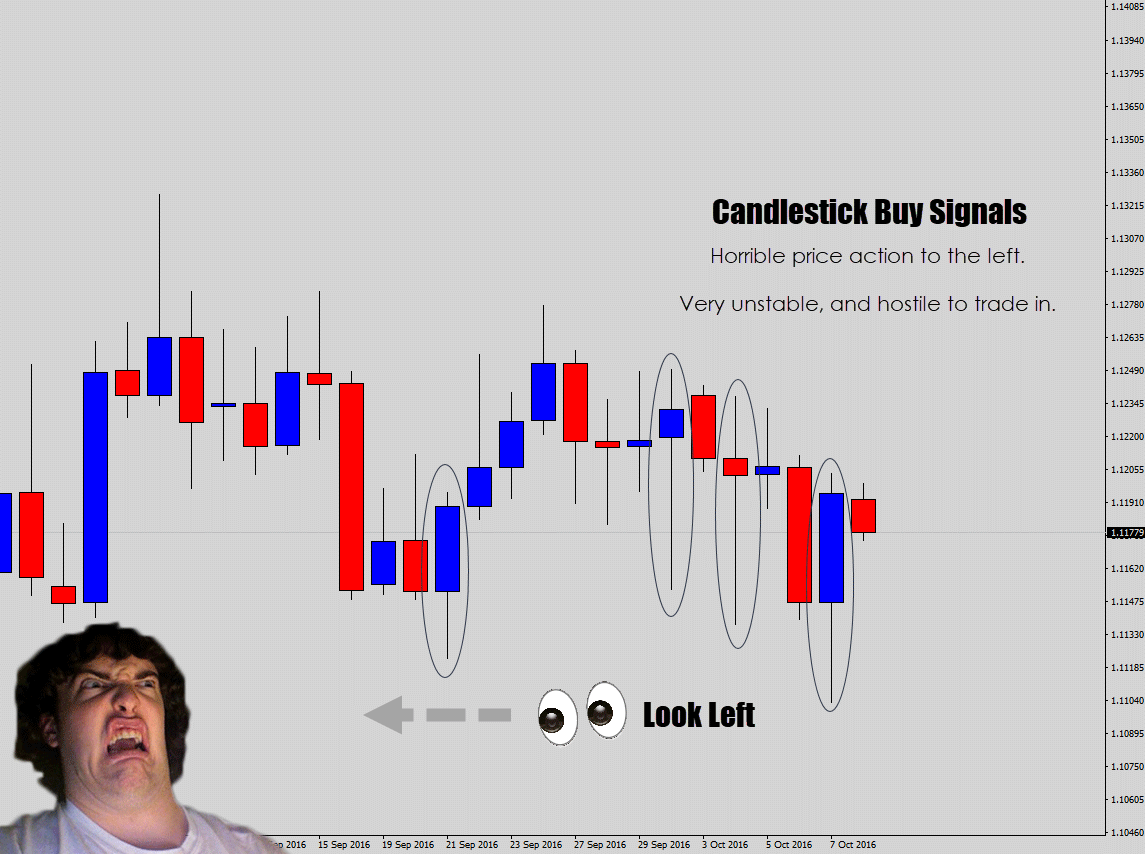

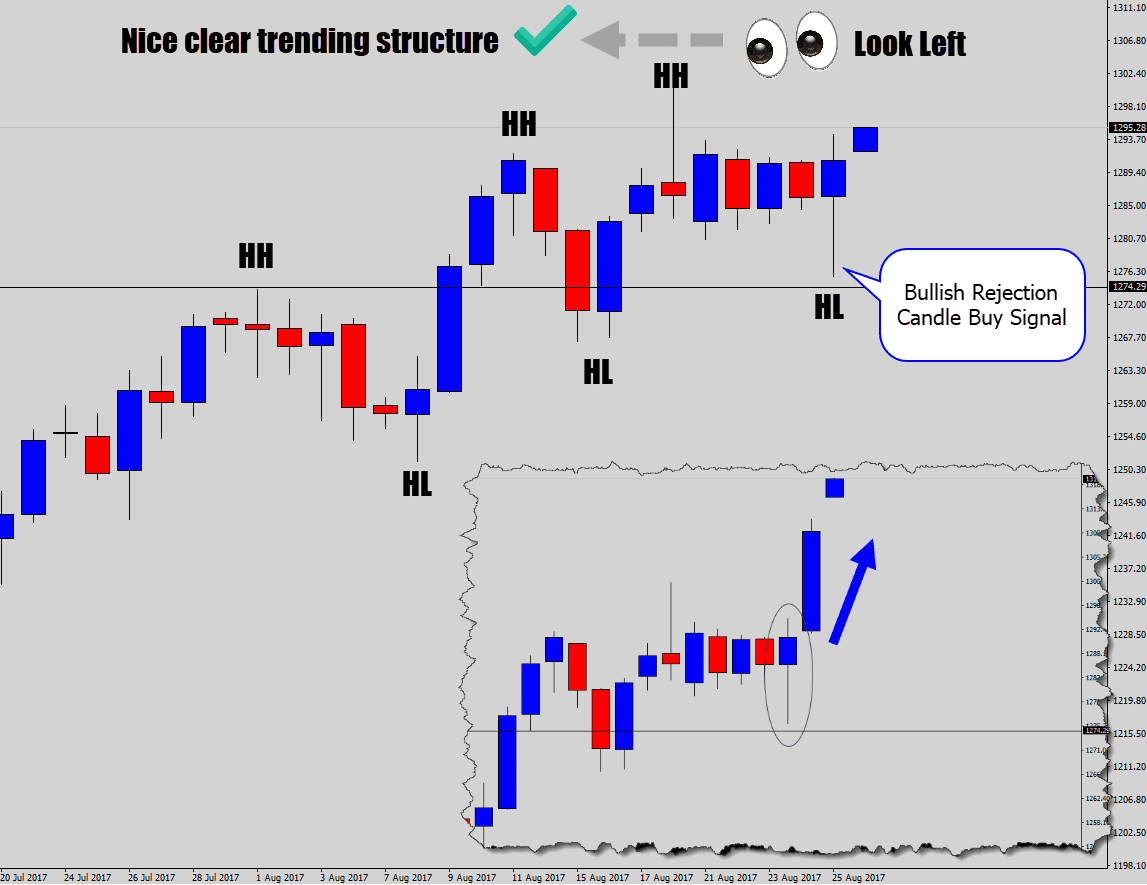

One of the quickest ‘spot checks’ you can do on your chart is have a look to the left.

One of the quickest ‘spot checks’ you can do on your chart is have a look to the left.

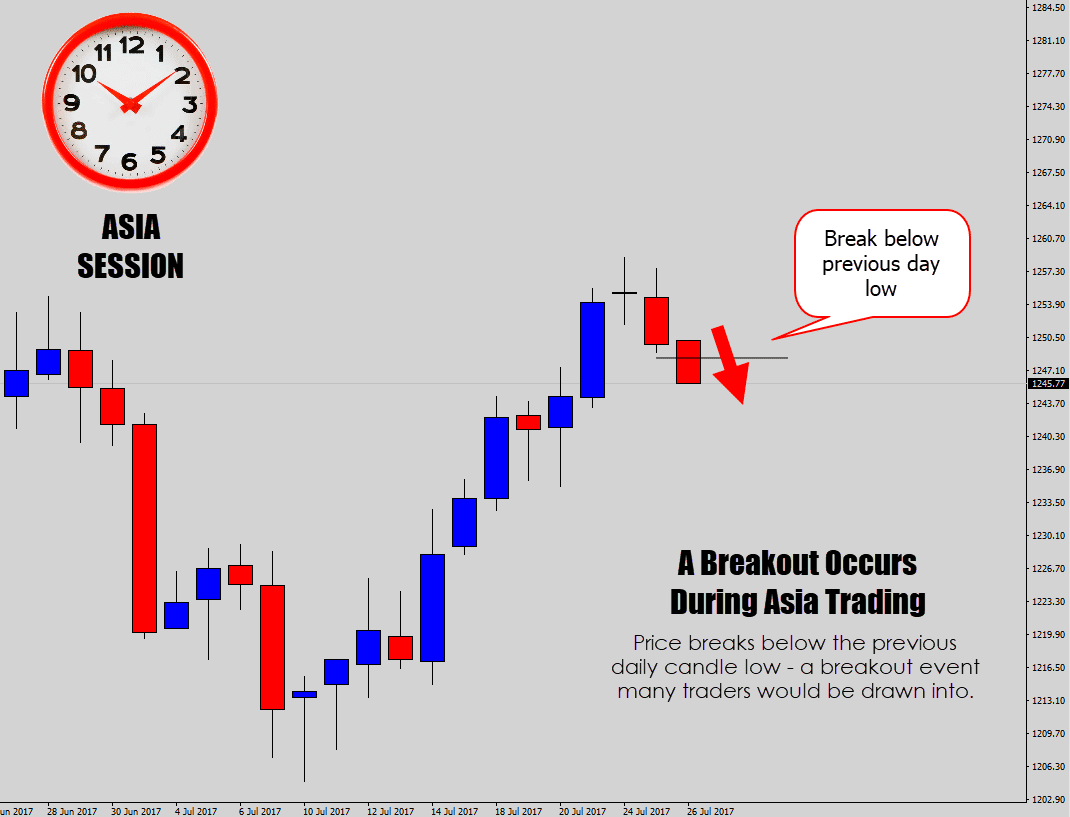

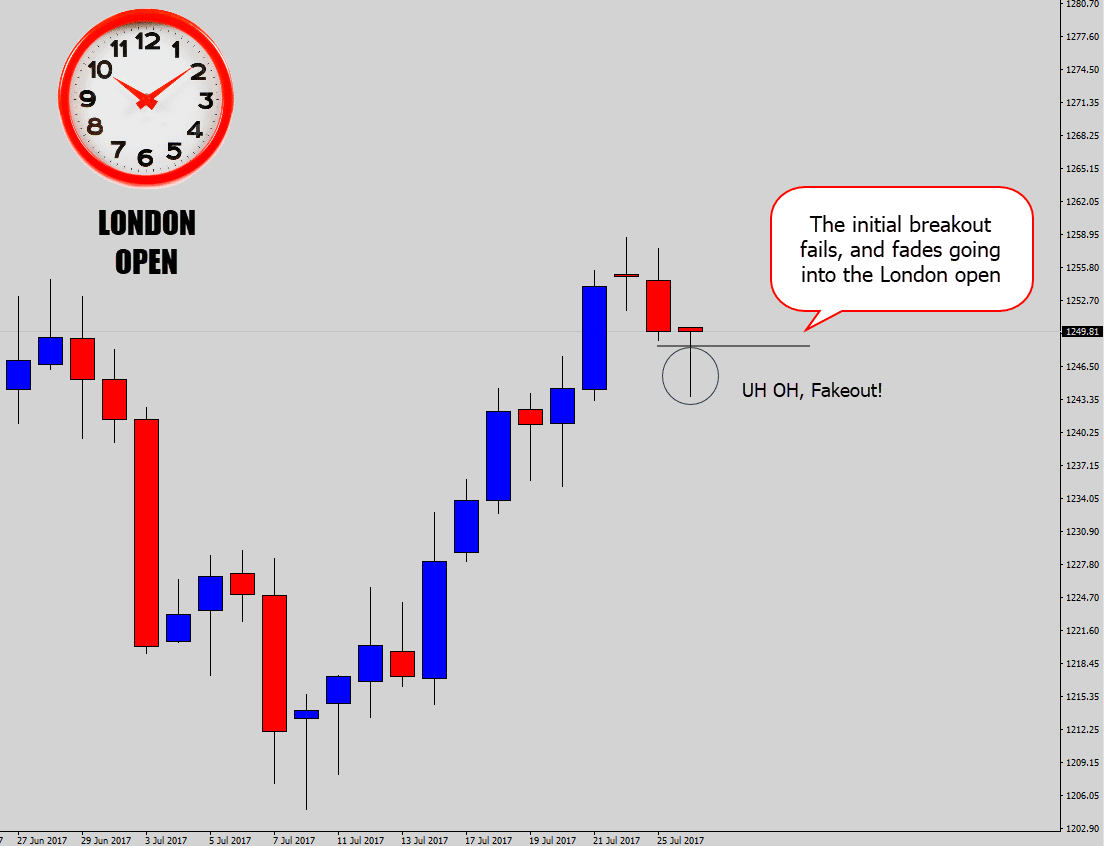

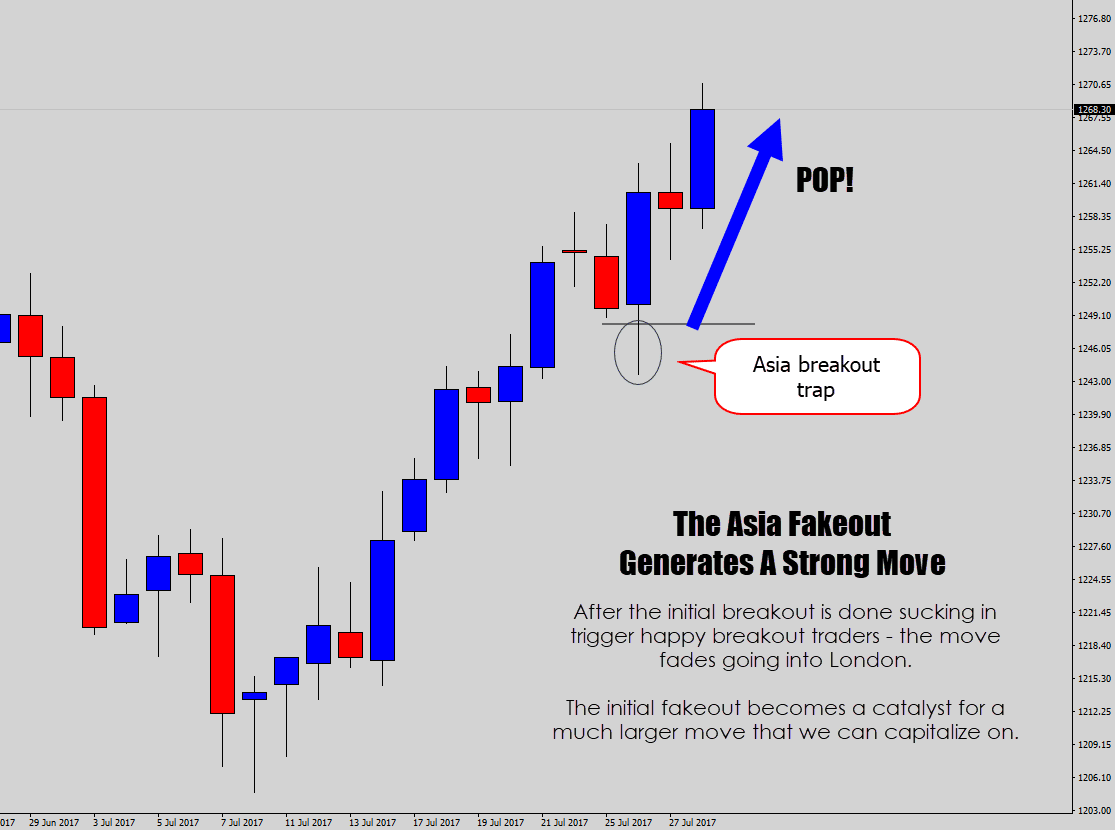

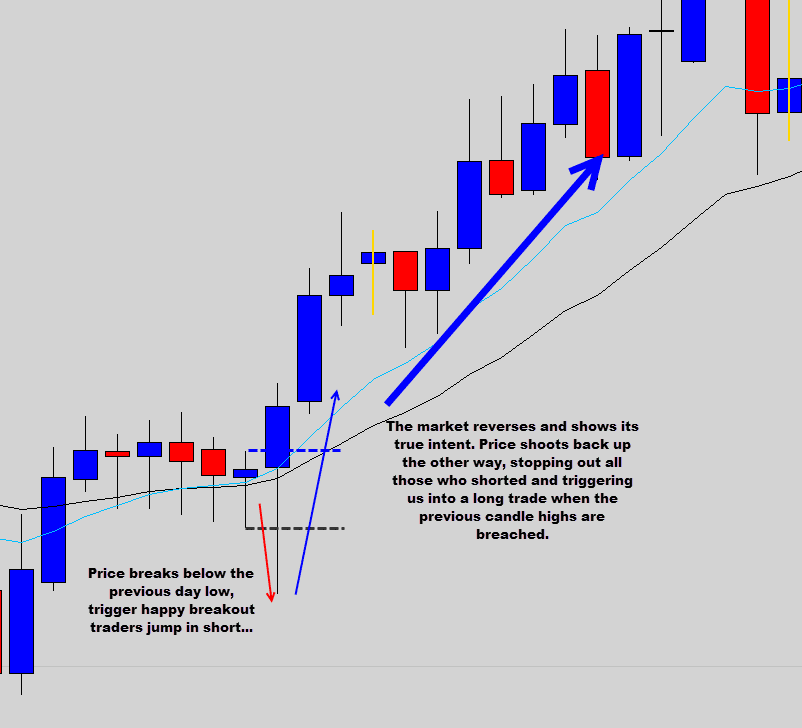

One element to a trading decision, is the timing.

One element to a trading decision, is the timing.