[Latest News][6]

#1 Live Trading on Glenmark Pharmaceuticals Ltd

#1 Live Trading on Godrej Industries Limited

#3 Live Trading Session

1-2-3 Strategy

1-2-3-4 Reversal Trading Strategy

10 CHART PATTERNS FOR PRICE ACTION TRADING

10 Habits of successful traders

10 Performing Candlesticks

10 PRICE ACTION BAR PATTERNS YOU MUST KNOW

10 PRICE ACTION CANDLESTICK PATTERNS YOU MUST KNOW

10 Things You Can Learn From The World’s Best Traders

10 TYPES OF PRICE CHARTS FOR TRADING

123 forex trading strategy

123 Trading Strategy

200 SMA

3 Bar Net Line Strategy

6 Best Price Action Trading Strategies

7 RSI TRADING STRATEGIES

9 Advanced & Profitable Trading Strategy

9 Funny Facial Expressions

AB = CD Price Action Strategy

Abb India Limited

Aditya Birla Nuvo Limited

Aditya Birla Nuvo Ltd

ADVANCED REVERSAL STRATEGY

Alice Blue Opening Link

Alphabets

Amaraja Battries

Ambuja Cement

Anupam Rasayan India Limited IPO

Asian Paint Ltd

Aurobindo Pharma Limited

Bajaj-Auto

Bearish Crossover

Bearish Engulfing

Bearish Engulfing Candle

Bearish Reversal (Red-Red)

BEML Ltd

Best Stock Market Strategy

Bharat Finance Inclusion

Blood Rain Pattern

bollinger band

Bollinger Band Price goes below Mid line Strategy

Bollinger Band Price gone above mid line

Bollinger Band Strategy

Breakout Stock Trading Strategy

Bullish Crossover

Bullish Engulfing

Bullish Gartley Pattern Strategy

Bullish Three Bar Reversal

Butterfly Spread

Cadila Healthcare Limited

Calendar Spread

Camarilla Equition

canara Bank

Candlestick Charts

Candlestick Patterns

Candlestick Patterns Strategy

Cesc Limited

Chart Patterns

Cipla

Closing Above Previous High for 3 Days

Closing Below Previous Low For 3 Days

coal India

Cup & Handle Pattern

Daily Life of a Trader

dark cloud cover

Day Trading Breakout

Day Trading Setups

Day Trading Setups – 6 Classic Formations

Day Trading Strategy

DBLHC

Descending Triangle

Divergence Price Action Strategy

DIVI'S Laboratories Ltd

Doji Candlestick Patterns

Dojis

Double EMA

Dr Reddy

Dr. Reddy's Laboratories Limited

Early Morning Range Breakouts – 4 Trading Strategies

EMA

Equity Market

EXHAUSTION BAR

Falling Wedges (26th Dec 2017)

Federal Bank

fibonacci

Fibonacci Retracement

Fibonacci Retrenchment Strategy

Fibonacci swing trading strategy

Flag Pattern Strategy

Flash Pattern

Forex Trading Strategies

Fyers Account

Gandhi Jayanti

Gap Up

Gartley Pattern

Glenmark Pharmaceuticals Limited

godrej

Godrej Consumer Products Limited

Godrej India

Gppl

Happy Birthday

Happy Chhath Puja

Happy Diwali

Happy Diwali (2017)

Happy Diwali (2018)

Happy Dussehra

Happy Ganesh Chaturthi

Happy Holi

Happy Independence Day 2017

Happy Janmashtami

Happy Krishna Janmashtami 2017

Happy Muharram 2017

Happy Navratri To All

Happy Teacher Day

Harmonic Pattern

HCL Technology

HDFC

HDFC Bank

Head & Shoulders breakout

Head & Shoulders Pattern (6th Oct 2017)

Head and Shoulders Pattern

Higher high of 3 days

Hikkake Pattern

Hindustan Petrolium

Hindustan Unilever

Hindustan Unilever Limited

HOW TO DRAW TRENDLINES

How To Trade Supply And Demand

IndusInd Bank

Indusind Bank Ltd

Infosys

INSIDE BAR

Inside Bar - Outside Bar

Inside Bar Trading Strategy by Stock Alphabets

Inside Day Bar

Intraday

Intraday strategy

Intraday strategy with Camarilla Equition

intraday SureShot

Intraday SureShot Official Post

Intraday Trading Strategy

Intraday/Day Trading Strategy

inverted Head & Shoulders

Irb Infrastructure Developers Limited

Iron Condor

Iron Fly

Island Reversal Pattern Trading Strategy

Jindal Steel & Power Limited

Jk Lakshmi Cement Limited

Jubilant Food

Jubilant Foodworks Limited

Kajaria Ceramics

KEY REVERSAL BAR

Kingfa Science and Technolgy (India) Ltd

Kotak Mahindra Bank Limited

Larson & Tarbo

LIC

LIC Housing Finance Limited

Live Trading

Lupin Limited

M & M Finance

Mahanagar gas

Making Higher High for 3 Days

Making Lower Lows for 3 Days

Master Candle

Master Candle Strategy

Master Plus Candlesticks

Meditation

Mind Tree

Mindtree

Mobile App & Website for share market

Momentum Divergence Strategy

Morning and Evening Stars

Moving Average Strategy

My 10 price action secrets

Naked Options

NBCC (India) Limited

New Mobile Application Annoucement

NHPC

Nifty Trend (12th August 2017)

Nifty Trend line (10th August 2017)

NMDC

NMDC Cup & Handle Pattern

NR7

NTPC

Nureca Limited IPO

Option Strangle (Long Strangle)

Options Strategy Newsletter

OUTSIDE BAR

Outside Bar-Inside Bar Combo Pattern

Pattern Strategy

PATTERNS

Pidilite India

PINOCCHIO BAR (PIN BAR)

PINOCCHIO BAR TRADE SETUP (PIN BAR)

Piramal Enterprises Limited

planting trees

PNB

POPGUN BAR PATTERN

Price action

Price Action Candlestick Patterns

Price Action Continuation Patterns

Price Action PATTERN # 6: Pin Bars

PRICE ACTION PATTERN #1: DBLHC

Price Action PATTERN #4: BEOVB

Price Action PATTERN #5: BUOVB

Price Action Patterns

Price Action Pivot Point Strategy

Price Action Sandwich Trading Setup

Price Action Strategy

Price Action Strategy Guide

Price Action Strategy lover

Price Action Trading Class

Price Action Trading Course

Price action trading strategy

Price came back channel from bottom

Price came back channel from Top

Price gone below mid line

Price-action-trading-strategies #Chapter-01

Price-action-trading-strategies-#Chapter-02

price-action-trading-strategies-#Chapter-03

Price-action-trading-strategies-#chapter-04

Profitable Level

Profitable Level (13th Dec 2017)

Profitable Level (14th Dec 2017)

Profitable Level (15th Dec 2017)

Profitable Level (18th Dec 2017)

Profitable Level (18th Sept 2017)

Profitable Pattern

Profitable Trader

Profitable Traders Do Nothing 99% Of the Time

PVR

RailTel IPO

Ratio Spread

Raymond Limited

Reliance Capital

Reliance Infra

Repco Home Finance

REVERSAL BAR PATTERN

Risk/Reward

Ross Hook Pattern Trading Strategy

RSI

RSI Divergence Strategy

SBI

Shooting

Six Candle Concepts

SMA

Sodha

Spring at Support & Resistance

State Bank of India

Stock Alphabets

Stock Market

Stock Market & Finance Movies

Stock Market Strategy

StockAlphabets

Stop Loss Order

Straddle

Strangle

Strategy EMA

Strategy Resource

Strip/ Strap

sun Pharma

Sun Pharmaceuticals Industries Limited

Supertrend

Supertrend Strategy

support & Resistance

Support & Resistance (25th Sept 2017)

Support & Resistance (26th Dec 2017)

Support & Resistance Strategy (6th Dec 2017)

Support and Resistance

Swerve pattern

Swing Trading Strategies

Swing Trading Strategy

Tata Chemical

Tata Global Beverages

Tata Motors

TCS

The Best Stocks to Buy Now or Whenever

The India Cements Limited

The Outside Bar Trading Strategy

Three Bar Reversal

Three Candle Formation

THREE-BAR PULLBACK

Titan Company Limited

Top Indian Companies with Monopoly

Top 10 Continuation Candlesticks

TOP 10 PRICE ACTION TRADING BOOKS

Top 10 Reversal Candlesticks

Top Monopoly stocks in India

Torrent

Torrent Pharmaceuticals

Traders Trick Entry Trading System

trading breakout

Trading Key Reversal Bar

Trading Psychology

Trading Strategy

Trading Strategy For Posstional & Intraday

Trading System

Trading the trend

Trend line (25th Sept 2017)

Trend line Strategy

Trend line Strategy (14th Dec 2017)

Trend Trading Analysis Prediction

Trend-line Strategy (30th Nov 2017)

Trendline

Trendline (19th Sept 2017)

Trendline (6th Nov 2017)

Trendline Line Strategy

Trendline strategy

Trendline Strategy (19th Dec 2017)

Trendline Strategy (2nd Dec 2017)

Trendline Strategy (6th Dec 2017)

Triagle Pattern

TV18 Broadcast Limited

TWO-BAR REVERSAL

Types of Trader

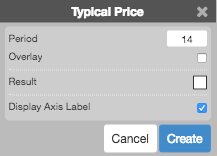

TYPICAL PRICE

Typical Price Action Strategy

ubl

UBL Breakout

Ujjivan

Ujjivan Financial Services

United Breweries Limited

United Phosphorus Ltd

Vertical Spread

Volume Candlesticks

Volume Trading Intraday Strategy

W Pattern

Wedge Pattern Strategy

Wedges Price Action Strategy(16th Dec 2017)

wedges Strategy (19th Dec 2017)

Wipro Limited

Wockhardt Limited

Wolf Wave Strategy

World’s Best Traders

www.StockAlphabets.com

Yes Bank

Zee Entertainment Enterprises Limited

Zydus Wellness